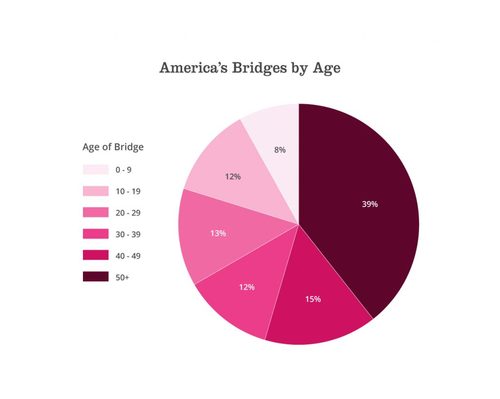

It is estimated that more than 60,000 bridges in the US are considered “structurally deficient”, traffic delays cost the US economy more than $50 billion annually and there are unsafe levels of lead in the drinking water of over 2,000 water systems across all 50 states.

For these reasons, infrastructure was a huge talking point throughout the last general election, with both Donald Trump and Hillary Clinton unveiling major plans to give the US infrastructure system a much needed overhaul.

The American Society of Civil Engineers (ASCE - the US’s oldest and largest engineering industry group) release a ‘report card’ on the country’s infrastructure every 4 years. In 2017 the US received a D+, and with the highest ‘pass rate’ being a C there was plenty of room for improvement. Some individual categories like transit fared slightly better achieving grade B but with others such as Rail falling behind with a D-, the US is far from being top of the class.

The ASCE comments that “Infrastructure is the foundation that connects the nation’s businesses, communities, and people, driving our economy, and improving our quality of life. For the US economy to be the most competitive in the world, we need a first-class infrastructure system [… ] Yet today, our infrastructure systems are failing to keep pace with the current and expanding needs, and investment in infrastructure is woefully inadequate.”

The Future Of The Industry

So, with Donald Trump set to unveil a $1 trillion infrastructure plan later this year, the future looks bright for the industry with many new opportunities set to present themselves. Like a true business man, Trump plans to allocate tax credits to private investors to complete the infrastructure upgrade. A white paper authored by Wilber Ross and Peter Navarro argues that allocating $137 billion of tax credits for private investors to underwrite infrastructure projects would lead to $1 trillion in infrastructure expenditures over a 10-year period.

This would entail a huge amount of private sector growth over the next few years and with that growth comes the need for skilled people who can see this huge undertaking through to fruition. The Ross-Navarro whitepaper estimates that each $200 billion spent on infrastructure creates $88 billion in wages for workers and increases gross domestic product growth by 1%.

There are already 14.5 million US workers in jobs ranging from construction to plant operation, but this won’t be anywhere near enough to complete the plans that President Trump has campaigned for. With the promised economic growth depending partly on an increase in employment and skilled workers, we believe there will be more call for people across all sectors to enter the infrastructure market. People with transferrable skills will be able to capitalise on this need for growth, and more focus will be put on young people joining the industry.

Recruiting people into these sectors will become a major priority for the companies taking on the infrastructure projects. Trump’s plan to invest in private companies ensures that tax payers won’t bear the brunt of the spend. In fact, Trump aims for this reboot of the national infrastructure not to cost the taxpayer a cent, as the tax credits used for the developments will be offset by the economic growth it provides. This puts a huge pressure on the private investors to deliver successful projects in line with the plans.

Potential Problems

However, the problem with infrastructure runs deeper than a lack of budget. According to Douglas Holtz-Eakin, a former director of the US Congressional Budget Office “The problem is that most infrastructure spending is for new projects, which attract more attention, rather than on maintenance of existing infrastructure […] It’s not always about how much money is spent, but about how it is spent.”

This poses a question about whether Trump’s potentially colossal spend on infrastructure may be missing some important issues? Allocating the tax credits to private companies will inevitably grow the economy and of course, create jobs. But could this potentially lead to the neglect of vital projects with a lower commercial value? Private investors will see profit as their priority. Therefore, they will be most willing to invest in the projects that generate revenue (bridges onto which they can insert toll booths for example). Alongside this, President Trump needs to be seen to be proactively keeping his promise to improve infrastructure, and aren’t brand new projects much more visible than the refurbishments of old ones? By using private companies, does Trump run the risk of placing profit ahead of addressing the most vital upgrades needed to solve the infrastructure problems once and for all?

What It Means For Us...

However Trump and congress choose to progress with the infrastructure upgrade, there is no doubt that, if it goes ahead, it will be great news for the sector. Government tax credits will mean that companies in construction, engineering, rail and many more will have the scope to grow, take on new projects and of course open up a lot of exciting job opportunities.

At CSG, we collaborate with companies worldwide who are working on some of the largest and most challenging infrastructure projects. Our network and relationships in the US mean we pride ourselves on finding the right people for hard to fill roles. We have built a specialist team of recruiters who have developed in depth knowledge and experience of infrastructure and construction in the US and are focused solely on recruiting for talent in these markets. If you would like to discuss your recruitment needs or are looking for a new challenge you can reach us by email at candidates@csgtalent.com or give us a call on +44 (0) 333 323 2000.